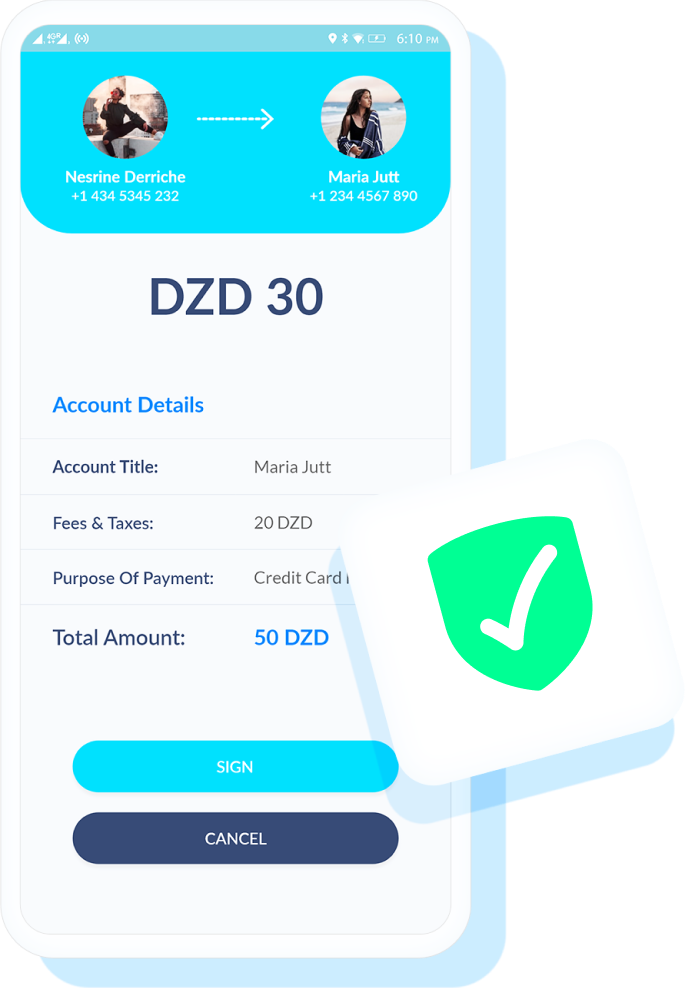

Before you send your payment, tap the toggle in the app to tell Vault Pay that you're paying for a good or service. Purchase Protection can be applied for eligible items, and the seller pays a small transaction fee.

When you shop in stores with your Vault Pay Debit Card, pay a Vault business profile, or use your Vault Pay account when making an in-app purchase or scanning a QR-code at checkout, your eligible purchases can be covered by Purchase Protection — no toggle needed. All so you can shop and pay with confidence.

Eligibility and get full Purchase Protection terms in our User Agreement

What is Purchase Protection

Purchase Protection is available on eligible Vault Pay Debit Card and Vault Pay business profile transactions, or when you use your Vault Pay account to make an in-app purchase or scan a QR code at checkout. It’s also available when you tell Vault Pay you’re paying for a good or service before you send a payment in the app. If something goes wrong, Vault Pay will investigate eligible purchases, work with the seller to help make it right, or even reimburse you for what you paid plus original shipping costs.

What issues could Purchase Protection help me with?

If you receive something that’s different from what you bought, an item was damaged in shipping, parts are missing, or your purchase never arrives, Purchase Protection could apply. You can read more about eligibility in our User Agreement.

What purchases could Purchase Protection cover?

Eligible Examples

Ineligible Examples

Is there a charge for Purchase Protection?

Purchase Protection is available for eligible transactions with no fees to the buyer and no additional fees to the seller. When you indicate you’re paying for a good or service in the app, or send a payment to a Vault Pay business profile, a transaction fee of 1.9% + $0.10 of the sale is charged to the seller. Purchase Protection is available in these transactions.

How do I file a Purchase Protection claim?

If you’re unable to solve the problem directly with the shop or seller, visit our Help Center or tap Get Help in the Vault Pay app menu, and Submit a Ticket.

Where do I go if I have more questions?

To learn more about Vault Pay Purchase Protection and how it works, check the Vault Pay User Agreement or visit our Help Center.

Vault Pay LLC is registered in the United States (No. 099387340) and authorized by the Financial Conduct Authority under Electronic Money Regulations 2023 (Firm Reference 900563). Operating as a financial technology company, Vault Pay is not an FDIC-insured bank. Banking services and FDIC insurance are provided in collaboration with Banks and Partners, both Members FDIC. The Vault Pay Visa® Debit Card is issued by Visa® Inc under a license. and is accepted wherever Visa® cards are recognized. All trademarks and brand names remain the property of their respective owners, and their use does not imply endorsement. All rights reserved. Standard data rates may apply.

When people send money to your personal profile and tell Vault Pay they're paying for a good or service, Vault Pay Purchase Protection may be available. You'll see a notification, and pay a small seller's transaction fee of 1.9% + $0.10.

Vault Pay Purchase Protection can help prevent losses due to fraud, saving you valuable time and money. Plus, it helps the people who buy from you feel more comfortable about the transaction.

Create a Vault business profile, and graduate from porch pick-ups to an official point of sale. You’ll get Purchase Protection as an included benefit on eligible transactions, which can help prevent fraud claims from hurting your bottom line. Plus, added features like getting a spotlight in the Vault Pay feed can attract new customers, so you can grow your business.

Eligibility and get full Purchase Protection terms in our User Agreement

What is Purchase Protection

Purchase Protection is available on eligible purchases, and could protect your sales in case someone files a qualifying claim for an unauthorized transaction or an item that is not received.

When is Purchase Protection available?

Purchase Protection is available on eligible sales made through a Vault Pay business profile. Coverage may also apply when people indicate that they’re purchasing physical goods or digital items and services in the Vault Pay app, but some restrictions apply. To help ensure your sales are protected, keep records that show the order was fulfilled, as well as proof of delivery.

How does Purchase Protection help sellers?

Purchase Protection helps guard you from losing money due to unauthorized transactions or claims that the buyer never received their purchase. If the sale meets our requirements, and you can provide proof that an order has been fulfilled, Vault Pay will prevent chargebacks from impacting your business.

How can I offer Purchase Protection?

To offer Purchase Protection, create and use a Vault Pay business profile for your sales transactions. While a seller transaction fee of 1.9% + $0.10 of the transaction does apply to business profile sales, Purchase Protection is available for eligible transactions.

To offer Purchase Protection, create and use a Vault Pay business profile for your sales transactions. While a seller transaction fee of 1.9% + $0.10 of the transaction does apply to business profile sales, Purchase Protection is available for eligible transactions.s

Where do I go if I have more questions?

To learn more about Vault Pay Purchase Protection and how it works, check the Vault Pay User Agreement or visit our Help Center.

Vault Pay LLC is registered in the United States (No. 099387340) and authorized by the Financial Conduct Authority under Electronic Money Regulations 2023 (Firm Reference 900563). Operating as a financial technology company, Vault Pay is not an FDIC-insured bank. Banking services and FDIC insurance are provided in collaboration with Thread Bank and Evolve Bank & Trust, both Members FDIC. The Vault Pay Visa® Debit Card is issued by Thread Bank under a license from Visa U.S.A. Inc. and is accepted wherever Visa® debit cards are recognized. All trademarks and brand names remain the property of their respective owners, and their use does not imply endorsement. All rights reserved. Standard data rates may apply.